Webinar for the Self-Employed: Take the Sting Out of Paying Taxes

Press Release

Get legal with your taxes, save money on tax preparation, and maximize your self-employed protections and deductions. Attend “Self-Employment: Taking the Sting Out of Paying Taxes”! (Applies to U.S. residents only.)

Speaker and long-term self-employed professional Pariah S. Burke lets you in on the facts and secrets of taking the sting out of paying taxes for self-employed professionals. Based on Pariah’s 20 years experience freelancing and owning design studios and other organizations, and augmented by tips and information directly from accounting and tax professionals, “Taking the Sting Out of Paying Taxes” will help the newly self-employed in any profession get legal with taxes and filings and show even the experienced self-employed maximize their deductions, minimize their tax preparation expenses, and streamline tax management tasks.

Attend this Webinar for self-employed and freelance professionals to learn:

* Are you required to pay quarterly taxes? If so, how?

* A technique using multiple bank accounts to stay on top of quarterly and annual taxes.

* Do you need to incorporate?

* What the pros and cons of S-Corps, LLCs, LLPs, and other types of organizations.

* Techniques for saving money when hiring an accountant.

* What deductions are you missing?

* How do you report payments to vendors and subcontractors?

* Tracking income, expenditures, receipts, and deductions on the go.

* Protecting your personal assets from business litigation.

* And more!

Webinar Date and Pricing

The webinar will take place on Thursday, June 2, 2011, from 10:00 AM – 2:00 PM (PT).

Early Bird Price (ends May 15, 2011): $199

Regular (Single Ticket) Price: $245

Group Rate Discount (5 or More Tickets): $169

Click here to register.

Special tip: Your ticket to this webinar is itself tax-deductable!

This article was last modified on January 18, 2023

This article was first published on March 7, 2011

Commenting is easier and faster when you're logged in!

Recommended for you

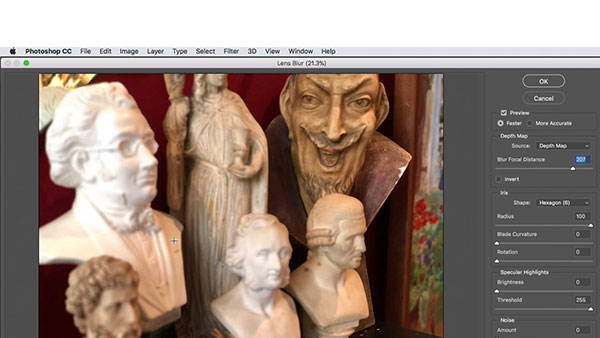

Changing Image Focus with Photoshop CC 2018

Dual-camera iPhones like the iPhone 7 Plus, iPhone 8 Plus, and the iPhone X have...

Printing and Exporting Alternate Layouts

The Alternate Layouts feature in InDesign CS6 is cool, but it does make some thi...

The Strange Case of the “Editing and Out of Date” Status

I get a lot of screen shots of InCopy UIOs (Unidentified Interface Objects) sent...