The Art of Business: It Pays to Pause for a Little Year-Round Tax Planning

Tax planning is not the most appealing subject, I know. But you might think differently if you figured out how much you might end up saving by planning throughout the year, rather than just at year’s end.

I recommend that you download the free 2006 Essential Tax & Wealth Planning Guide, provided by Deloitte Tax LLP (Figure 1). The 60-page document includes tax and investment tips to help you reduce your tax burden.

Figure 1. The 2006 Essential Tax & Wealth Planning Guide is helpful and free.

To see what tax deductions are still available to you for the 2005 tax year, take a look at the IRS Tax Guide for Small Businesses.

You can use the following tax and financial planning calendar to recognize and act on the various milestones, starting with tax-savings tips and financial planning strategies you can focus on now during the first quarter of the year.

If you’re really interested in doing it right, plug these following dates into your calendar. Come this time next year, you’ll be happy you did.

First Quarter

General

- Complete Form W-4 and adjust withholding if needed. (You can download it and many other forms mentioned in this article on the IRS Web site.)

- Apply for a Social Security number for any child who doesn’t have one.

- Consider filing tax returns early in those states or jurisdictions where discounts are provided (e.g., Florida).

- Determine whether it’s advantageous to pay any taxes with credit cards.

January 17

- Pay fourth-quarter estimated taxes for the preceding tax year.

- Make quarterly defined benefit Keogh contribution for the preceding year.

January 31

- Give domestic employees their copies of Form W-2, Wage and Tax Statement.

March 15

- If you’re a U.S. owner of a foreign trust, ensure that the trustee files Form 3520-A, Annual Information Return of Foreign Trust with a U.S. Owner, or that the trustee applies for an extension to file on Form 2758. If the trustee fails to file, the U.S. owner may be subject to penalties.

Second Quarter

April 1

- Comply with minimum distributions rules for qualified plans by April 1 if you attained age 70-1/2 in the previous year.

April 15

- File individual and gift tax returns (or an application for an extension).

- File Schedule H (Form 1040) with your tax return if you paid cash wages of $1,400 or more in 2004 to a household employee.

- Report federal unemployment tax (FUTA) on Schedule H if you paid total cash wages of $1,000 or more in any calendar quarter of 2004 to household employees.

- Make first-quarter estimated tax payment.

- Make prior-year IRA and Coverdell Education Savings Account contributions.

- Make prior-year Keogh or SEP plan contributions. If you applied for an extension to file your tax return, these contributions are not due until you timely file your tax return.

- Make quarterly defined benefit Keogh contribution for the current year.

- If you have transacted with a foreign trust (e.g., owner, transfer to or distribution from a foreign trust, hold a qualified obligation of a foreign trust, or receipt of certain gifts or bequests from a foreign person), file Form 3520.

June 15

- Pay second-quarter estimated taxes.

- If you filed for an extension to file Form 3520-A (originally due on March 15), file the form.

June 30

- File Form TD F 90-22.1, if necessary. Generally, each U.S. person who has a financial interest in or signature authority, or other authority over any financial accounts, including bank, securities, or other types of financial accounts in a foreign country must report that relationship on Form TD 90-22.1. The requirement is only necessary where the aggregate value of the financial accounts exceeds $10,000 at any time during the calendar year.

Third Quarter

July 15

- Make quarterly defined benefit Keogh contribution for the current year.

July 31

- File Form 5500, Annual Report of Employee Benefit Plan, if applicable.

August 15

- If you extended your individual tax return, file the return or file for another extension.

- File Form 3520, if your individual tax return was extended, and filing of the form is necessary.

September 15

- Pay third-quarter estimated taxes.

Fourth Quarter

General

- Begin your year-end tax planning:

- Project your current year and next year tax liabilities.

- Evaluate the applicability of the AMT and other taxes.

- Adjust withholding, if necessary.

- Evaluate year-end capital transactions.

- Establish a separate Keogh for self-employment income.

- Comply with minimum distribution rules for qualified plans.

- Evaluate before-tax and voluntary after-tax contributions to retirement plans.

October 15

- File individual and gift tax returns extended at August 15.

- File Form 3520 (if necessary) if your individual income tax return was extended at August 15.

- Make quarterly defined benefit Keogh contributions for the current year.

- Recharacterize a Roth IRA conversion or change a prior-year contribution from one type of IRA to another (if your individual returns were extended at August 15).

Throughout the Year

- Re-evaluate your long-term strategies.

- Evaluate your tax and financial strategy for receiving discretionary and mandatory retirement plan distributions.

- Evaluate investments on an after-tax basis.

- Rebalance your investment portfolio and re-evaluate your uses of debt.

- Consider income shifting to maximize family wealth by making gifts up to the annual exclusion amount or up to your lifetime exclusion amount.

- Evaluate passive-loss exposure and potential investment shifts.

- If you have excess cash flow, consider how to invest those funds.

- Optimize mix of interest expense items.

- Consider making charitable contributions of property.

- Consider ways to fund your child’s education.

- Evaluate your mix of portfolio and passive income.

- Review prior gifts to children under age 14 and their incomes to minimize the amount of income that will be taxed at your top marginal rate.

- Review the selection of your second residence and status of your vacation home.

- Be mindful of expiring credits, tax reductions, and exemptions.

- Review resident and non-resident filing requirements for federal and state income, estate, gift, and generation-skipping tax purposes.

This article was last modified on December 14, 2022

This article was first published on January 9, 2006

Commenting is easier and faster when you're logged in!

Recommended for you

Tip of the Week: Searching for Glyphs

With this free InDesign script, you can fix problematic text wrap with precision...

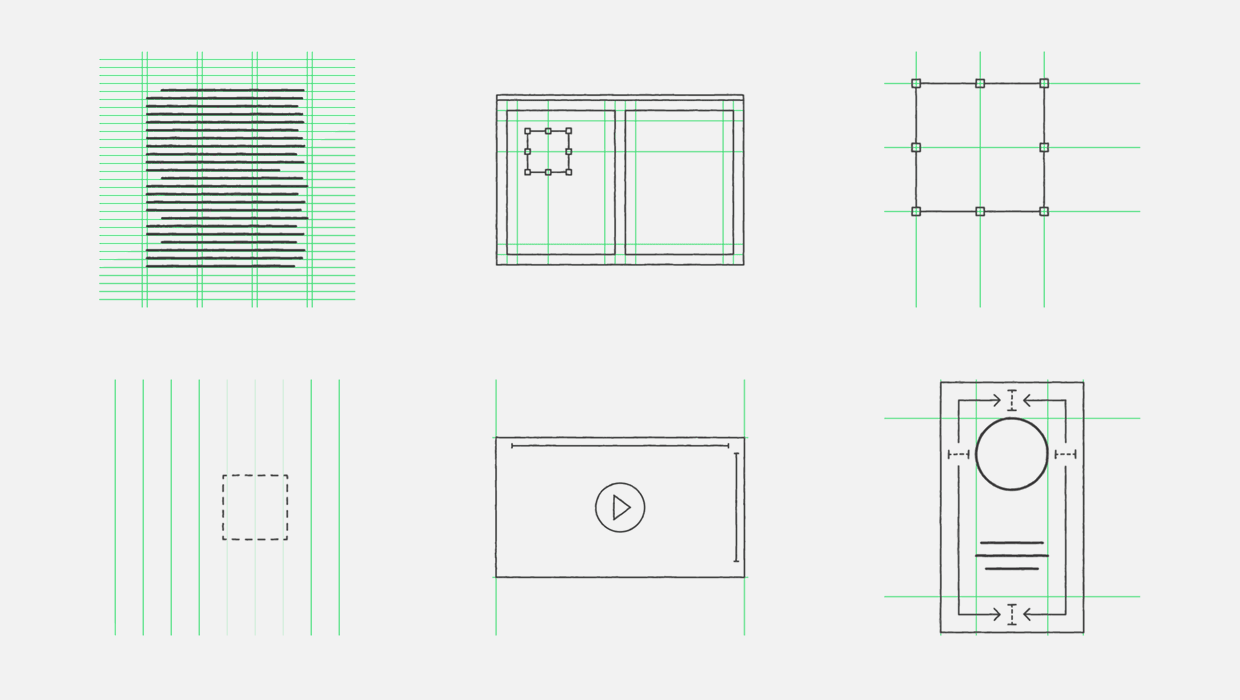

InReview: GuideGuide

Create guides and grids galore, with minimal fuss and maximum convenience.

Avoid These 6 Common Type Mistakes

Learn to avoid these six mistakes and you can take your typography skills from O...